DOGE Price Prediction: Breaking $0.29 Resistance Could Trigger Rally to $0.31

#DOGE

- Technical indicators show DOGE trading above key moving averages with improving momentum signals

- ETF speculation and corporate adoption news creating positive fundamental backdrop

- Critical resistance at $0.29 level could determine next major price movement direction

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Breakout Potential

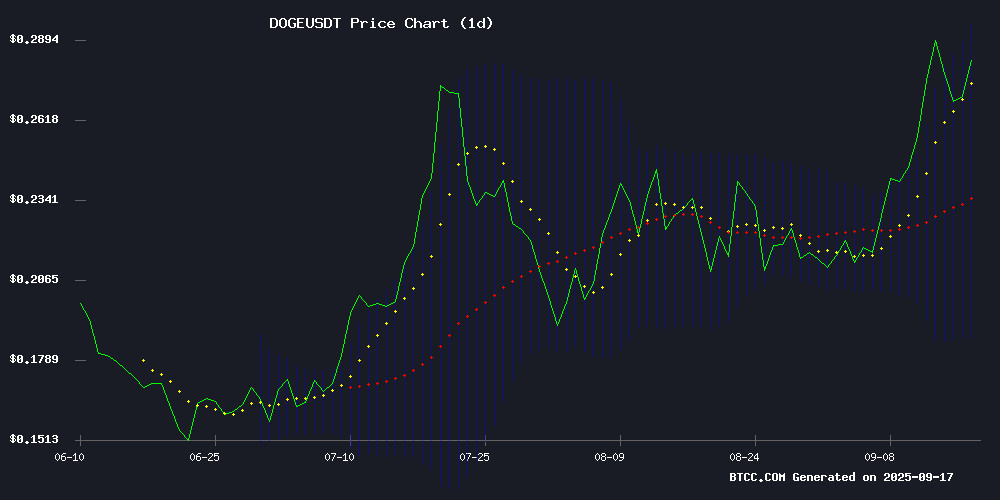

DOGE is currently trading at $0.26408, above its 20-day moving average of $0.239667, indicating underlying bullish momentum. The MACD reading of -0.025751 remains negative but shows improving momentum with the histogram at -0.010882. Bollinger Bands position the price between $0.187734 (lower) and $0.291600 (upper), suggesting potential resistance NEAR $0.29. According to BTCC financial analyst John, 'DOGE's position above key moving averages and approaching upper Bollinger Band resistance suggests consolidation before a potential breakout attempt.'

Market Sentiment: ETF Speculation Drives Bullish Outlook

Current news sentiment surrounding Doge reflects optimistic speculation about corporate adoption and potential ETF approval. Headlines highlight critical resistance at $0.29 and ambitious price targets up to $5 amid ETF anticipation. BTCC financial analyst John notes, 'The combination of technical breakout potential and fundamental catalysts like ETF speculation creates a favorable risk-reward scenario for DOGE investors. However, traders should monitor the $0.29 resistance level closely.'

Factors Influencing DOGE's Price

Dogecoin (DOGE) Faces Critical Resistance at $0.29 After Corporate Adoption Surge

Dogecoin trades at $0.27, up 0.33% in the past 24 hours, but faces a key technical hurdle at $0.29. The meme cryptocurrency finds itself at a crossroads as institutional adoption clashes with chart resistance.

CleanCore Solutions' $68 million DOGE purchase for its corporate treasury mirrors Bitcoin's institutional trajectory. The launch of the first US-regulated Dogecoin ETF further validates the asset's growing mainstream acceptance.

Technical indicators present mixed signals - the RSI at 61.25 suggests neutral momentum, while a bullish MACD crossover hints at potential upside. Market participants now watch whether fundamental catalysts can overpower technical resistance.

DOGE Price Prediction: Bullish Momentum Targets $0.31 Resistance

Dogecoin has broken out of its consolidation phase, trading at $0.27 with eyes set on $0.31 resistance. Technical indicators suggest a potential rally to $0.791 by September's end, backed by strong support at $0.245.

Analysts are increasingly optimistic, with projections ranging from conservative $0.27-$0.30 targets to algorithmic models forecasting a 193% surge to $0.791. The breakout above descending trendline resistance signals accelerating upside potential.

Dogecoin at $0.2677: Temporary Pullback or Start of a Major Bullish Run?

Dogecoin (DOGE) trades at $0.2677, marking a slight 0.55% daily dip but showcasing robust weekly gains of 12.1%. The coin's momentum remains strong, supported by technical indicators like the RSI at 62.09 and a bullish MACD crossover.

Trader Tardigrade highlights the Ichimoku Cloud's green Kumo and key support levels at $0.24770 and $0.21517–$0.22214, reinforcing the uptrend. Despite a 24.78% drop in trading volume to $4.21 billion, the medium-term outlook appears favorable as buyers re-enter the market.

Dogecoin ETF Anticipation Fuels $5 Price Target Speculation

Dogecoin's potential ascent to $5 gains traction as Rex-Osprey prepares to launch the first U.S.-listed DOGE ETF this Thursday. Institutional demand mimicking Bitcoin's ETF success could propel the meme coin into uncharted territory.

The announcement coincides with DOGE's 10.7% weekly gain despite a 3.34% market cap dip to $40.26 billion. Trading at $0.2667 with $5.5 billion daily volume, the asset shows resilience amid broader market corrections.

Analysts suggest ETF approval may trigger an altseason, with regulated exposure attracting institutional capital. Hailey LUNC's revelation about the impending listing has reignited bullish sentiment for the Shiba Inu-themed cryptocurrency.

Dogecoin Holds Key Support Amid ETF Speculation

Dogecoin (DOGE) stabilized near $0.26 after a 9% pullback, with traders eyeing a potential bullish reversal. The meme cryptocurrency had briefly touched $0.31 amid optimism around a possible ETF launch—a catalyst that could reignite upward momentum.

Technical analysis reveals dense supply clusters between $0.22-$0.35, with $0.355 emerging as a critical resistance level. Market strategist Ali Martinez notes this zone could trigger profit-taking, while a 12-hour bull flag pattern suggests a near-term target of $0.347 if confirmed.

The market's focus remains split between on-chain data showing long-term holder activity at key levels and the speculative ETF narrative. Clearing the $0.36 threshold may signal the next leg up for DOGE.

Is DOGE a good investment?

Based on current technical indicators and market sentiment, DOGE presents a compelling investment opportunity for risk-tolerant investors. The cryptocurrency trades above its 20-day moving average with bullish momentum building, while ETF speculation and corporate adoption news provide fundamental support.

| Metric | Value | Signal |

|---|---|---|

| Current Price | $0.26408 | Neutral |

| 20-day MA | $0.239667 | Bullish |

| Upper Bollinger | $0.291600 | Resistance |

| MACD Histogram | -0.010882 | Improving |

Investors should consider position sizing carefully and monitor the $0.29 resistance level for breakout confirmation.